MARPOL Annex VI requires all ships to use fuels with a sulphur content of 0.50% m/m from 1 January 2020 onwards (in emission control areas, other limits apply). The implementation date is subject to a decision by the Parties to MARPOL Annex VI that these fuels are by then sufficiently available. In order to inform this decision, the International Maritime Organization (IMO) has commissioned the present study, which aims to assess the availability of fuel oil with a sulphur content of 0.50% m/m or less in 2020.

The study comprises three elements.

I. The demand for marine fuels in 2020 has been estimated, based on the fuel consumption of ships in 2012, projected increases in energy demand, the use of alternative compliance options such as exhaust gas cleaning systems (EGCSs) and the use of liquefied natural gas (LNG).

The study has developed three scenarios, a base case with transport demand growth, fleet renewal, LNG and EGCS uptake in line with current projections; a high case with higher transport demand growth and fleet renewal and lower uptake of EGCSs and LNG, leading to greater demand for compliant petroleum fuels; and a low case which is the mirror image of the high case.

II. A refinery supply model has been developed and calibrated to global fuel production in 2012. This model has subsequently been updated to 2020 by taking into account all refinery expansions and closures that are expected to be completed by mid-2019.

III. The model has been used to assess whether the global refinery sector will be able to produce the marine fuels in sufficient quantities in 2020, while at the same time meeting demand from other sectors, and whether the production of these fuels is economically viable. This model runs were based on the projected crude slate for each region (which is different from the 2012 crude slate). The model was run conservatively, by e.g. limiting the capacity utilization of key units to 90% of stream day capacity and using conservative estimates of sulphur removal rates while setting sulphur contents of marine fuels that were 10% lower than the limit.

The main result of the assessment is that in all scenarios the refinery sector has the capability to supply sufficient quantities of marine fuels with a sulphur content of 0.50% m/m or less and with a sulphur content of 0.10% m/m or less to meet demand for these products, while also meeting demand for non-marine fuels.

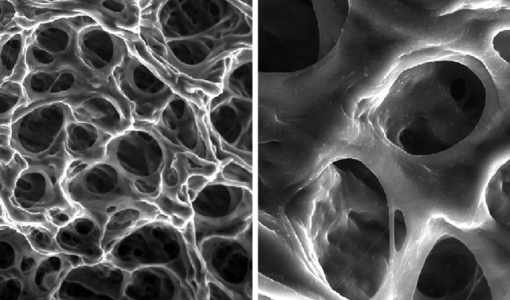

That future demand can be met is due to several developments. Capacity growth of crude distillation units enables production of larger quantities of fuel oil, while expansion of hydrocracking capacity increases the potential supply of unconverted gas oil, with a very low sulphur content which can be blended with heavy fuel oil to lower its sulphur content. Moreover, the increase in middle distillate and heavy fuel oil hydroprocessing helps meet the low sulphur requirements for marine distillates and heavy fuel oils, respectively.

In addition to these developments, the high-demand case requires refineries in the Middle East and Asia to increase the utilization rates of their refining and processing units and to change their crude oil slate. For example, the average sulphur content of the crude slate in the Middle East will need to be lowered from 2.01% in the base case to 1.99% in the high-demand case.

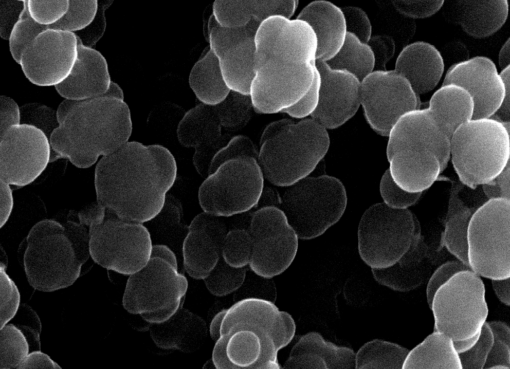

All compliant fuels (petroleum fuels with a sulphur content of 0.50% m/m or less) are blends of several refinery streams. Untreated atmospheric residue is typically only a fraction of the total blend. Most of these fuels have a considerably lower viscosity than heavy fuel oil (HFO).

While supply and demand are balanced globally, regional surpluses and shortages are projected to occur. In most cases the Middle East has an oversupply, while in some cases other regions have a higher production than consumption as well. Regional imbalances can be addressed by transporting fuels or by changing vessels’ bunkering patterns.